Traditional primary-market galleries should seize the opportunity to introduce transparency and build trust in order to attract a young generation of buyers and retain artists through a more nuanced revenue generation model. Real-world art tokenization would enable individuals and organisations to create a digital proof of ownership, authentication, price transparency, transaction history, fractional ownership, financing, lending, etc. There is a strong disconnect between an art industry behind an opaque veil and the thirst of a new audience eager to claim an active role, engage in their own terms and benefit from it.

What is NFT art? A Non Fungible Token is an intangible digital asset comprised by a unique code, a record on the blockchain, which includes its creation date, ownership rights and transaction history.

NFTs are a sign of the times: the need of a younger generation to disrupt and to rebel against a conservative generation that holds power and financial means and that have resisted change. The financial and power ties of conservative business models in the art world are another version of a tired and crony political system and a stagnant financial model.

NFTs aren’t new, proto-versions have existed in virtual worlds like World of Warcraft and Eve Online for more than a decade and made headlines for the monetary value associated with their transactions. NFTs have now come into focus because they allow for a more equitable distribution of the gains among creators, distributors and buyers/resellers. NFTs are a system to monetise digital content creation which had been abused and taken advantage of for a long time.

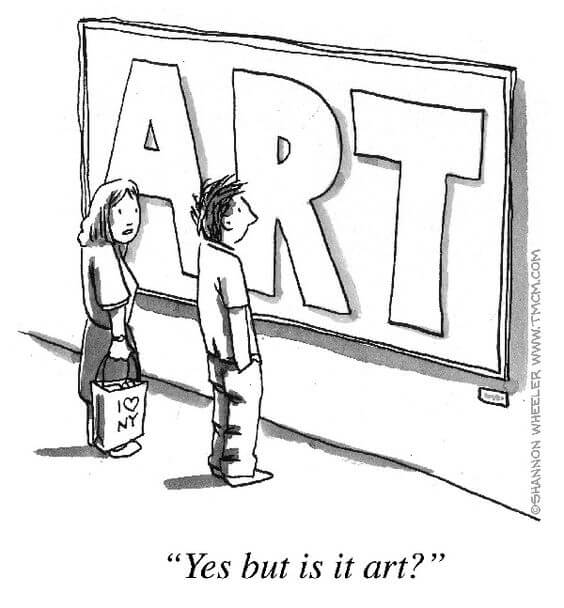

Tradition vs. Disruption

Key traditional (i.e. physical) art market participants are having a hard time understanding two things. First, how digital content can be elevated to the category of art. That in itself is the sad evidence that many still put traditional visual art in a higher pedestal than other art forms. Second, how NFT art is any different from previous disruptors who gained personal notoriety but changed nothing for the traditional art market. Think Damian Hirst or Banksy, who bypassed primary-market gatekeepers and made headlines by selling directly at secondary-market auction for larger sums.

The First 5000 days by Beeple, the first purely digital NFT art to sell by a major auction house, sold for $69M at Christies on March 11th. The work is a composite of 5,000 digitally created images, one for each day since May 1st2007. The fact that Christie’s also announced they would accept crypto as payment, one giant step closer to validating it relative to fiat currency, was a historical moment in itself. Metakovan, the pseudonymous founder of part crypto/NFT impact fund and part content production company Metapurse, is the buyer of the work. Back in January, Metapurse announced that it had spent more than $2.2m on buying the complete set of 20 first edition works of art in the Beeple Everydays: The 2020 Collection via a NiftyGateway auction. The statement is an open declaration of intentions where “acquisition is phase one” and “Up next is a project and event that flips the art world status quo on its head.” There it is, by their own admission, the sale is a trojan horse publicity stunt. The purchase is part of a plan, they needed the sale to take place at a major platform to make it as bombastic a statement as possible and they have since announced they will commission a digital museum to house the work.

True Colours

Metapurse is an investment fund that produces, buys and sells digital content for investment purposes, that has used one of the major art auction houses as a trampoline to mainstream media to not just amplify a message of confidence on crypto and NFT investment but make it clear that they will intervene in the market with no distinction between primary and secondary transactions. Talk about mastering the trade of conflict of interests. Not just they set themselves to flip the art world status quo but they have doubled down.

If the traditional art market places value in scarcity, the asymmetry of access to information and lack of transparency, Metakovan and Metapurse as its platform are muddying the waters even further. Sadly, rather than the promise of transparency and openness that the crypto ecosystem represents, the Beeple sale at Christies is yet-another missed opportunity to truly engage the wider public.

Pre-pandemic, the art market knew it needed reinvention and openness in order to attract new audiences, specifically to capture the generational wealth transfer from boomers to millennials. A $64 billion industry, the global art market stands on shaky foundations. For starters, few arbiters of taste, including critics, curators, gallerists and collectors act as gatekeepers and control artists’ access to and progression within the market. Second, there is no legal ownership title; an art object is yours simply because it is in your possession but there is no true legal document that attributes ownership, other than highly-falsifiable invoices and certificates of authenticity. Finally, artworks carry an opaque authenticity and transaction history, including provenance and value. It is no fluke that independent professional advice is highly recommended.

Bubble or Revolution?

NFTs are a technological revolution but not an artistic one. They are indeed a technological revolution because they open up access to artists and content distribution. The price to mint (put into code) an artwork ranges between $60-250 and, at least to date, digital marketplaces like NiftyGateway, MakersPlace or OpenSea seem more leveled than the traditional gallery system. Nonetheless, it is a similar immense sea to navigate from an audience point of view.

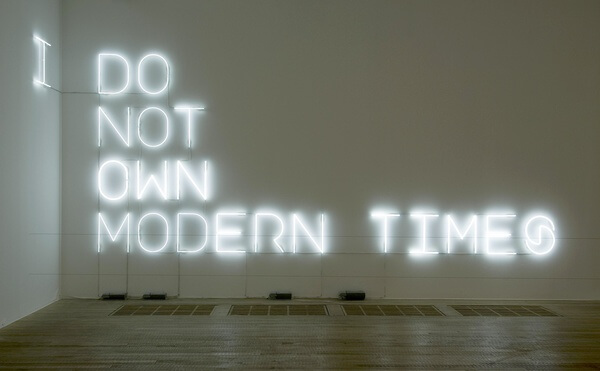

The truly game-changing element of the blockchain technology behind NFTs benefits creators because smart contracts are built in, so that artists don’t lose out on subsequent commercial transactions of the work and get a commission in the future. Intellectual Property rights and licensing activity could trigger automatic payments to authors. Whilst Artists’ Resale Rights are in place already, they are enforced differently in each country and include many requirements and exceptions that render its impact insignificant. On the other hand, blockchain empowers the artist to automate and effortlessly control, monetise, and manage their IP in ways that have never been possible before.

This technology is not new but the conservatism of the art industry ignored it until now because it was not in the advantage of the big players to implement it. For an industry that is meant to be creative, its lethargy and resistance to change is rather telling. Surprisingly, the blockchain-based art investment platform Maecenas introduced art-tokenization in 2018 with the sale of a painting by Andy Warhol. Whilst the fintech firm implemented a revolutionary concept of fractional ownership in art, it applied it to fine art masterpieces by deceased artists as a pure investment vehicle. I believe art-tokenisation applied to the primary-market to be the real revolution.

Traditional primary-market galleries should seize the opportunity to introduce transparency and build trust in order to attract a young generation of buyers and retain artists through a more nuanced revenue generation model. Real-world art tokenization would enable individuals and organisations to create a digital proof of ownership, authentication, price transparency, transaction history, fractional ownership, financing, lending, etc. There is a strong disconnect between an art industry behind an opaque veil and the thirst of a new audience eager to claim an active role, engage in their own terms and benefit from it.

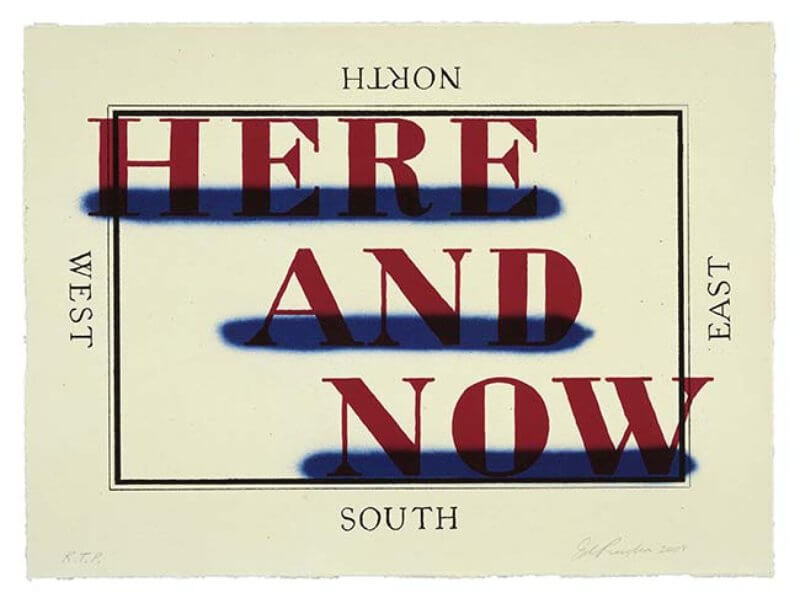

As for the artistic revolution, art is art in any form: physical or digital, ephemeral like performance or immutable and reproducible like a GIF or a video, respectively. Creative minds don’t distinguish and narrow by format. There is more art that is bad, superficial and mediocre than good and transformative. It’s part of the creative process and I deeply love it all, in all forms. Digital art is not something that excites me in the same way as traditional arts because I live for the experience and the live encounter, the sense of scale, the smell of materials and their tactility. I am no digital native. Yet, I am certain that great art will come from the virtual environment. Different art formats require different marketing and distribution models and purely digital creators and marketplaces are a welcome introduction to the traditional art industry. If there is a swelling bubble at the moment, it will adjust. When the bubble ends, greater opportunities will remain.

Home Truths

My colleagues in the art world will agree that we have done a disservice to the industry at large by failing to communicate why art is vital, worth engaging with and preserving, as opposed to a commodity for a cultural elite and the wealthy. We have traditionally placed value in scarcity, access asymmetry and opacity of information. Without a doubt, the status quo needs to be challenged. Art only makes headlines when high-value deals are brokered. Yet, more art is within the reach of the vast majority than not. How are we in the art world engaging that majority?

We need art and we need a vision. We need sustainable business models where a career in the arts is not a risky passion project. We need an open conversation about what it truly means to support the difficult career of an artist in all its life-stages. We need to embrace the role of collectors and accept that they are active participants in the market as opposed to ignoring their influence until it is so big it cannot be ignored. Arbiters of taste and gatekeepers on their high-horses do a disservice to cultural openness and industry resilience.

Art is essential. Content is not free. NFTs prove that people value art and trust the technology behind it. I look forward to the opportunities that are opening up for the art market. The industry is full of prospects for artists, business innovation investors, collectors and true supporters of the arts.

If you would like to discuss how IñigoArt can assist you in your art acquisitions or to understand the art market further, please do not hesitate to get in touch.

Marina Ribera Iñigo